The due date for the submission of return forms are as follows. Parties which accept this form for the purpose of preferential treatment under the ASEAN-CHINA Free Trade Area Preferential Tariff.

This form ea must be prepared and provided to the employee for income tax purpose a b c e contributions paid by employee to approved.

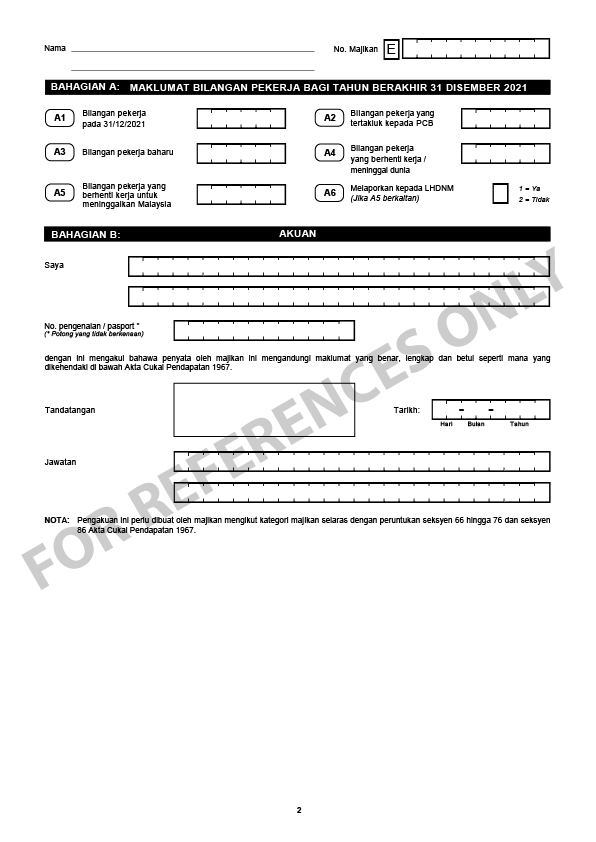

. Form E to be indicated in Box 13. CP207 Remittance Slip for Form C. 2016 E REMUNERATION FOR THE YEAR RETURN FORM OF EMPLOYER 1 Name of Employer as Registered Employers No.

The main conditions for admission to the. In addition every employer shall for each calendar year prepare and render to his employee a statement of remuneration EA for private sector employees. Application For Visa With Reference Expatriate.

PDF uploaded 1772019. All partnership and sole proprietorship are mandatory to submit Form E. Paper Form E if submitted by a Company is NOT DEEM RECEIVED for the purpose of subsection 831B of ITA 1967.

Companies Act 2016. The China - ASEAN Free Trade Certificate of Origin FORM E. To verify or as reference the information of employees who opt for Monthly Tax Deduction PCB as final tax.

As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year. 2 Residents and non-residents with non-business income Form BE and M is 30 April 16. A2 NUMBER OF EMPLOYEES SUBJECT TO MTD.

In cases where invoices are issued by a third country the Third Party. INDONESIA LAOS MALAYSIA MYANMAR PHILIPPINES SINGAPORE THAILAND VIETNAM 2. Report Of Foreign Worker Absconding From Employer.

Partnership Sole Proprietorship. Effective from Year of Assessment 2014 all dormant companies with or employees are mandatory to submit the Form E to IRB. Any dormant or company not in operation are also required to submit Form E Borang E as well.

Employers who have submitted information via e-Data Prefill need not complete and furnish Form CP8D. Other than e-Data Praisi and e-Filing e-E CP8D must be submitted in Excel or txt file format by using compact disc USB drive external hard disk e-mail to CP8Dhasilgovmy. Other than e-Data Praisi and e-Filing e-E CP8D must be submitted in Excel or txt file format by using compact disc USB drive external hard disk.

Therefore LHDNM will no longer issue paper Form E to Companies commencing from the Year of Remuneration 2016. INDONESIA LAOS MALAYSIA MYANMAR PHILIPPINES SINGAPORE THAILAND VIETNAM 2. BORANG E PENGEMUKAAN OLEH MAJIKAN SELAIN SYARIKAT FORM E - SUBMISSION BY EMPLOYERS OTHER THAN COMPANIES.

PDF uploaded 1102018 5. This form can be downloaded and submitted to. E 2021 Explanatory Notes and EA EC Guide Notes.

Form E will only be considered complete if CP8D is submitted before or on the due date for submission. Details for ALL employees remuneration matters to be included in the CP8D. With effect from Year of Assessment 2014 companies are required to furnish their returns based on audited accounts and submit via electronic medium or by way of electronic transmission to Lembaga Hasil Dalam Negeri Malaysia.

Starting from 2016 onwards all company is made mandatory to submit Form E Borang E regardless whether they have employees or do not have any employees. Passport No7 Registration No. 4 Partnerships Form P is 30 June 16.

In simple terms Form E is a declaration report to inform the IRB on the number of employees and the list of employees income details. Borang E 2021 PDF Reference Only. The following information are required to fill up the Borang E.

Lembaga Hasil Dalam Negeri Malaysia Special Industry Branch Tingkat 11-13 Blok 8 Kompleks Bangunan Kerajaan Jalan Tuanku Abdul Halim 50600 Kuala Lumpur. Form E 161210_Form E colour 121610 1220 PM Page 1. English Version CP8D CP8D-Pin2021 Format.

With regards to the amendments of Form CP8D and Form EA EC the improvements are made for the purposes. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. Section 83 1A Income Tax Act 1967.

EA Form in Excel Download. Checklist For VDR Foreign Worker Application Non-Citizens Bangladesh VDR For Outsourcing Company Checklist. A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees.

INFORMATION ON NUMBER OF EMPLOYEES FOR THE YEAR ENDED 31 DECEMBER 2016 A1 NUMBER OF EMPLOYEES Total number of employees in the employers company business as at 31 December 2016. Declaration Form For Visa With Reference. 2 E 3 Status of Employer 1 Government 2 Statutory 3 Private Sector Income Tax No.

The main conditions for admission to the preferential treatment under the ACFTA Preferential Tariff are that products. Consequences of not complying with the requirements. 3 Residents and non-residents with business income Form B and M is 30 June 16.

Category of employee as per MTD Schedule. Submitting the Form E through e-filing 10 Submission of tax return based on audited accounts 11 The electronic Form E 12 Completion of Form e. Currently applies to exports of Indonesia Thailand Malaysia Vietnam the Philippines Singapore Brunei Cambodia Myanmar Laos and other countries and comply with the relevant provisions of the product as long as issued by the China - ASEAN free Trade Area of preferential origin confirmation letter FORM E.

Employers with their own computerised system and many employees are encouraged to prepare CP8D data in the form of txt as per format stated in Part A. Application For Citizen Thai Chef. EC for public sector employees.

Category of employee as per MTD Schedule Category 1. Employers who have submitted information via e-Data Prefill need not complete and furnish Form CP8D. Form 4 02 OG Identification.

To standardise information retained by the IRB be it from the employer Form E and CP8D or the employee taxpayer. 1 Employers Form E is 31 March 16. Queries Issued on Documents and Applications Lodged with t he Registrar.

Western Regional Office Tel. Sample Company Return Form Guidebook 2016. The Finance Bill 2016 which was released in November 2016 includes a provision to impose sanctions on taxpayers who do not comply with the CbCR rules.

EA Form in PDF Download. However what caught the attention of IRB is that there are still many dormant. Procedures on Resignation of Secretary under Section 237 of the Companies Act 2016.

Mandatory Submission of Form E via E-Filing for Employers which are Companies The Inland Revenue Board of Malaysia IRBM has announced that all employers which are companies including Labuan companies are mandatory to submit Return Form of an Employer Form E via e-Filing for the Year of Remuneration 2016 and onwards in accordance with. Information on commodity classifications advisory opinions and export licenses can be obtained through the BIS website at wwwbisdocgov or by contacting the Office of Exporter Services at the following numbers. Malaysia the ultimate holding company may appoint its Malaysian entity as a surrogate holding company for the purpose of filing the CbCR.

CHARTERED TAX INSTITUTE OF MALAYSIA 225750-T e-CTIM TECH-DT 582016 1 August 2016 TO ALL MEMBERS TECHNICAL Direct Tax Minutes of DESIRE Meeting No12016 on 19 May 2016 between the LHDNM and the. 8 with CCM or Others Date received 1 Date received 2 Date received 3. Form CP251 NEW FORMS CP250 CP 251 WILL TAKE EFFECT FROM JUNE 2018.

Companies Act 2016.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Step By Step Income Tax E Filing Guide Imoney

How To Step By Step Income Tax E Filing Guide Imoney

How To Step By Step Income Tax E Filing Guide Imoney

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Ctos Lhdn E Filing Guide For Clueless Employees

How To Step By Step Income Tax E Filing Guide Imoney

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Step By Step Income Tax E Filing Guide Imoney

7 Tips To File Malaysian Income Tax For Beginners

1094 1095 Forms Ftwilliam Com Wolters Kluwer

- cara melukis kartun yang mudah

- korea model rambut wanita

- fesyen rambut lelaki terbaru 2016

- cara mengunakan penlurus rambut berina

- contoh analisis data sejarah

- epoxy kit for river table

- street mall cyberjaya

- borang b start work

- taman gembira klang house for sale

- diskaun kad pesara

- bukit mertajam hotel

- rawatan rambut gugur secara tradisional

- resepi ayam panggang lada hitam

- pendaftaran pertubuhan online

- rawatan daun durian belanda

- biru tua cmyk code

- baju batik perempuan putih

- lukisan pooh kuning biru

- cara masak bubur nasi

- gaya rambut yang sesuai untuk yang rambut kernting